-

Market Perspectives

Fewer Fireworks Going Forward?

July 2025

- Filename

- Market Perspectives July 2025.pdf

- Format

- application/pdf

TRANSCRIPT

The first half provided more than its share of oohs and aahs and urghs. Let’s spend a moment reviewing the first half and then shift our attention to the outlook for the second half.

Despite what the song says, I’m calling it a comeback.

The S&P 500 followed up a tough first quarter with a strong total return of almost 11% for the second quarter. That brought the first-half of 2025 total return to a bit more than 6% year-to-date.

Not bad given all the hand-wringing that occurred along the way, including the S&P 500 falling 19%, peak to trough, and narrowly avoiding a technical bear market — although the intraday low on the 7th did push the market past that -20% threshold.

The rebound from the April 7 intraday low to the close of June 30 was almost 30%, a long way from the Liberation Day angst. Allow me to bombard you with some numbers.

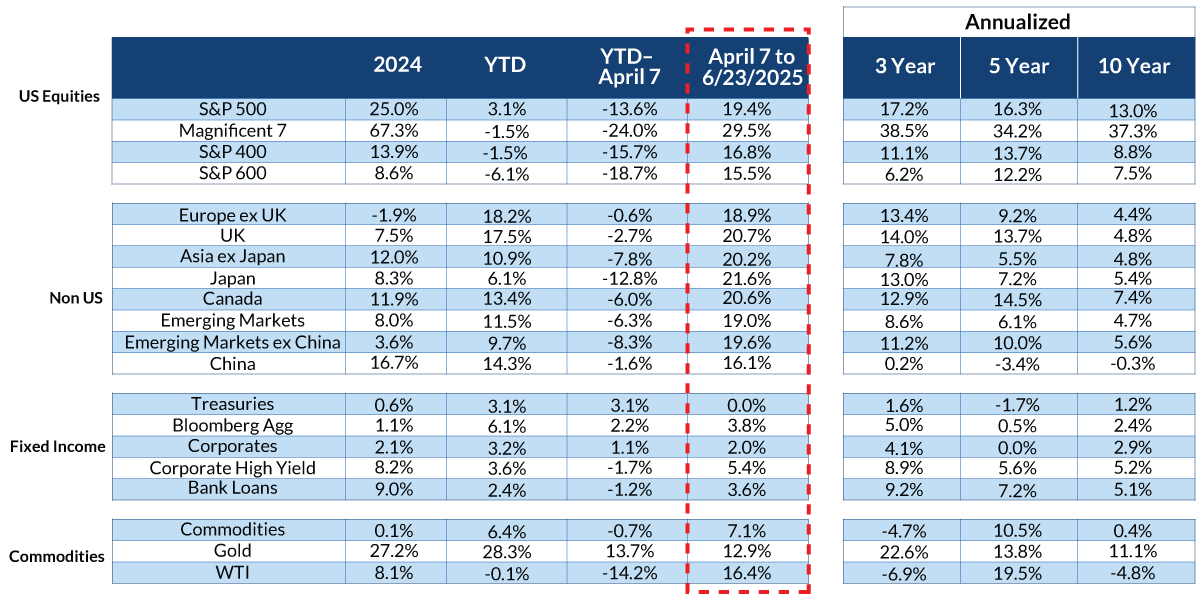

2025 Global Market Performance Dynamics

Data current as of June 23, 2025.

Sources: Bloomberg, CNR Research.

Past performance is no guarantee of future results.

Chart 1, 1:09— I’ll be your Sherpa as we navigate the number noise here. Focus your attention on the far-right boxes under Annualized.

U.S. large cap stocks have been the place to be, as the S&P 500 has outperformed the other major global indices on a 3-, 5- and 10-year annualized basis. That shifted in the beginning of this year, as global markets held up much better than the major U.S. markets. Recall in spring, we stated that we did not think this was a sustainable trend, but rather a short-term boost from a surge in fiscal spending coupled with a weakening U.S. dollar.

Since the April 7 market low, global returns have been largely correlated, with no clear regional advantage, even as dollar weakness continues. The relative direction of the U.S. dollar should remain key. However, recently its direction has been less correlated with market returns.

We maintain our U.S. focus but continue to evaluate possible allocations to non-U.S. equities.

Market Risk Measures Have Retreated From April Highs

Data current as of June 23, 2025.

Sources: Bloomberg, CNR Research.

Information is subject to change and is not a guarantee of future results.

Chart 2, 2:10— Risk sentiment improved quickly following the April lows and here at the midway point, we see improvement in some market risk measures.

A few that we focus on include the spread between investment grade and high yield corporate bonds, volatility measures like the VIX and MOVE, how tight or loose financial conditions are and gold and oil prices, both of which have stabilized since April.

But let’s not kid ourselves — there are still plenty of concern areas investors will have to contend with for the remainder of the year.

So how do we at City National Rochdale view the current environment and the possible path forward? Well, we expect GDP growth to slow but stay positive and above most other developed economies. Corporate profits have been a bright spot, meeting and exceeding expectations year-to-date, and we remain confident in the earnings outlook for U.S. companies.

The corporate spending backdrop remains constructive as investment in AI expands across companies in the S&P 500 and credit health shows no signs of deteriorating.

Inflation has moderated and the Fed’s 2% target seems within reach. Lower energy prices have been a factor recently, but the uncertainty of the eventual impact from tariffs is still to be seen and keeping the Fed cautious about easing rates too soon.

Geopolitical tensions are high and reached a crescendo in June because of the conflict between Iran and Israel. But markets took the risk in stride and volatility measures declined.

It’s worth noting that oil prices are at levels seen prior to the military escalation in Iran.

U.S. equity market valuations are high because of the rebound. However, they are below 2025 peak levels. Higher corporate profit growth has helped the valuation picture.

And then there are tariffs.

The tariff drama is proving persistent. Recently, the July 9 deadline was extended to August 1, buying some time for more deals to be made.

The three-week extension could result in a surge of imports and stockpiling, much like we saw earlier this year.

And that might have an impact on GDP spending and earnings numbers.

Tariff letters went out to various trade partners with the likely intent to jump-start trade talks.

Again, the longer-term impact on inflation is unknown at this point.

It appears that traders and investors are looking past tariffs, possibly viewing the proclamations as negotiating tactics or even bluffs, or traders and investors are simply getting used to the drama.

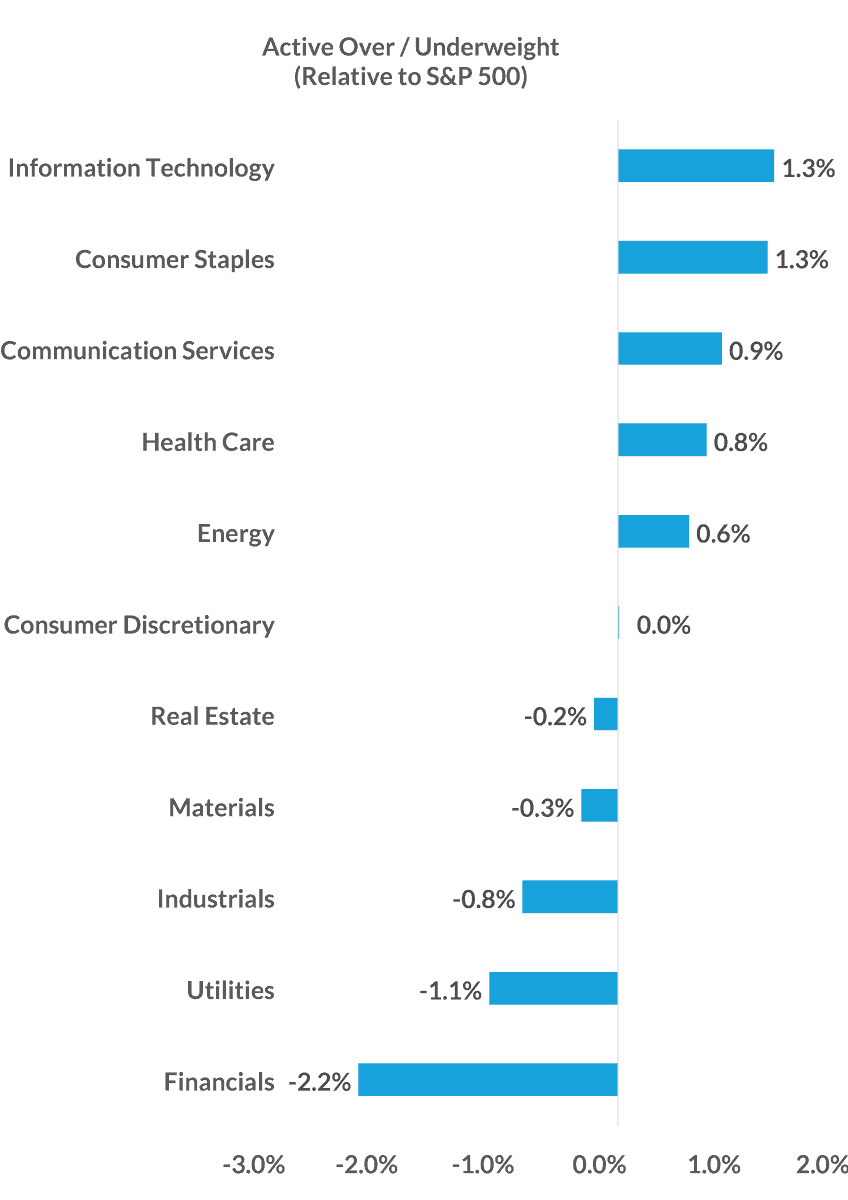

Sector Allocations For Flagship Core Equity Strategy

Technology

- Chip sales continue to soar on data center buildout.

- Companies spending heavily to integrate AI.

- Low valuation sensitivity.

Consumer Staples

- Historically economically resilient.

- Tends to outperform during instability.

- Declining real yield makes dividend payouts attractive.

Energy

- Cheapest sector with an attractive inflation hedge.

Financials

- Susceptible to additional Fed rate cuts.

- Adverse tariff outcome could cause consumer credit losses.

- Expensive valuations, potential for wider spreads.

Utilities

- Expensive valuation.

- Above average inflation expectations and a steeper curve could hurt rate sensitivity of the sector.

Consumer Discretionary

- At risk if consumers cut back spending or job market weakens.

- Sector most at risk from tariffs.

- Expensive valuations after the Q2 rally.

Chart 3, 4:50— Regarding sector allocations and equity portfolios, City National Rochdale recommends an overweight in technology, consumer staples and energy, and an underweight in financials, utilities and consumer discretionary.

City National Rochdale security selection remains slightly conservative at this point, and as always, patience and discipline are key to successful portfolio management.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness.

While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

Past performance or performance based upon assumptions is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.

Equity investing strategies & products. There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada.

© 2025 City National Rochdale, LLC. All rights reserved.

Index Definitions

The Standard and Poor’s 500 Index (S&P 500) is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance.

FactSet is a financial data and software company that provides computer-based financial data and analysis for professionals in the finance industry, including investment managers, hedge funds, and investment bankers. It consolidates data on global markets, public and private companies, and equity and fixed-income portfolios.

The Bloomberg Barclays US Corporate High Yield Index is an unmanaged, U.S.-dollar-denominated, nonconvertible, non-investment-grade debt index. The index consists of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the US and Canada.

MSCI Emerging Markets (EM) Index The MSCI Emerging Markets Index captures large and mid cap representation across Emerging Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI Europe Index captures large and mid cap representation across Developed Markets (DM) countries in Europe. The index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

The MSCI All Country World Index (ACWI) is a global stock index that encompasses nearly 3,000 companies from 23 developed countries and 25 emerging markets.

Stay Informed.

Get our Insights delivered straight to your inbox.

Check out previous perspectives:

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.